Ethereum derivatives volumes on the CME have plunged sharply following the launch of spot Ethereum ETFs, reflecting reduced institutional interest.

Trading volumes for Ethereum derivatives on the CME exchange experienced a significant decline in August as Ethereum futures volume plummeted 28.7% to $14.8 billion, while options volume dropped 37.0% to $567 million, marking the lowest levels since December 2023.

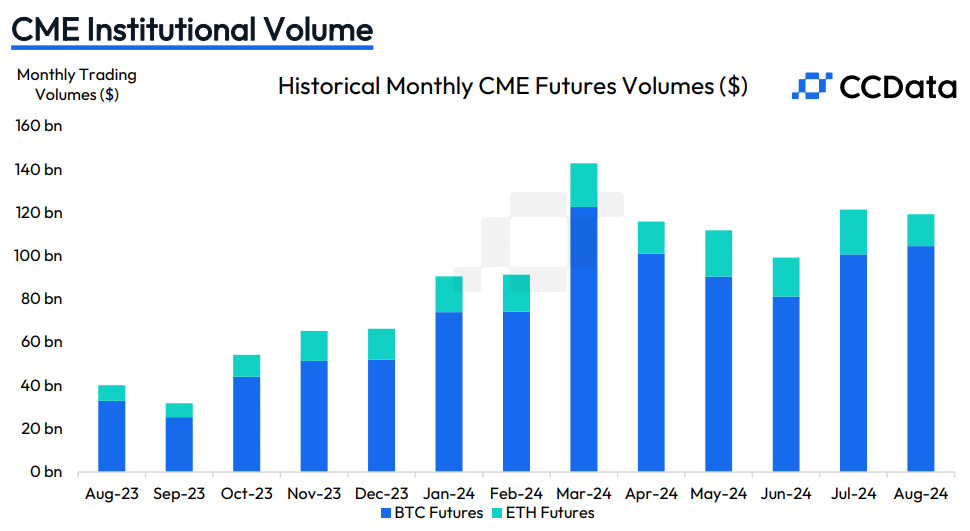

Data provided by CCData shows that the downturn comes just months after the introduction of spot Ethereum exchange-traded funds in late May, signaling “lower-than-expected institutional interest in the asset.”

Overall, CME’s derivatives trading volume plunged by 1.16% to $129 billion. While Bitcoin (BTC) futures saw a 3.74% increase to $104 billion, Bitcoin options trading fell by 13.4% to $2.42 billion. The drop in Ethereum (ETH) trading volumes contrasts with the robust performance of Bitcoin, which has surged over 45% this year compared to Ethereum’s more modest 20% rise.

As crypto.news reported earlier, crypto analyst Noelle Acheson attributed the reduced institutional interest in Ethereum ETFs to a preference for Bitcoin among investors seeking diversification. Acheson likened the current ETF landscape to the metals market, where gold ETFs command over $100 billion in assets, while silver ETFs hold less than $20 billion. Nonetheless, the analyst anticipates future growth in Ethereum ETF inflows, as institutional investors’ interest may increase over time.

The weaker performance of Ethereum is partly due to intensifying competition from competitors like Solana (SOL) and TRON (TRX), which are also attracting attention. Seasonality effects in August may also have contributed to the decreased trading activity, with expectations that this trend could extend into September.