Analysts at Coinbase Research predict macro pressures will dominate the crypto market in the next few weeks, citing a lack of specific catalysts.

The crypto market appears to be highly concentrated on macroeconomic events, according to a recent report from Coinbase Research Research. The report indicates that the market’s reliance on broader economic factors has intensified, with no immediate catalysts in sight to reverse the trend.

In an Aug. 9 research report, Coinbase’s analysts linked the Bank of Japan’s recent rate hike to the reversal of yen carry trades, which impacted global markets. Additionally, escalating tensions in the Middle East have made “many investors uneasy” about geopolitics, particularly concerns surrounding “oil supply,” the report noted.

Crypto remains dependent on macro factors

In addition to the macro pressure, the report says that the crypto market was further destabilized by a substantial liquidation event on Aug. 4, in which over $1 billion in perpetual contracts were wiped out within 24 hours, the largest such event since March.

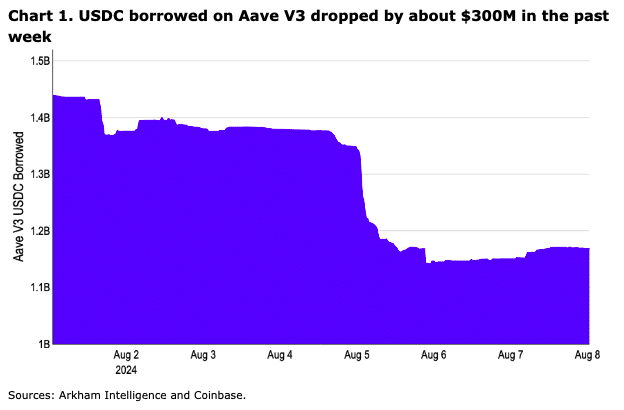

While this mass liquidation may have led to cleaner market positioning, liquidity “remains constrained,” with leverage in on-chain spot markets — measured by stablecoin borrow amounts — reduced significantly, the analysts said. “Given the absence of idiosyncratic catalysts for crypto in the next few weeks, we think macro dominance could continue,” analysts at Coinbase Research say.

Looking ahead, Coinbase maintains a “defensive approach” for Q3, expecting that macroeconomic factors will continue to drive crypto price movements, especially with upcoming U.S. inflation data likely to impact market sentiment.

However, not all analysts share this perspective. Grayscale Research, for example, recently suggested that if the U.S. economy achieves a “soft landing” and avoids a recession, token valuations could recover, with Bitcoin (BTC) possibly revisiting its “all-time high later this year.”