Fantom experienced a 17% increase in value, positioning it as the leading performer in the cryptocurrency market.

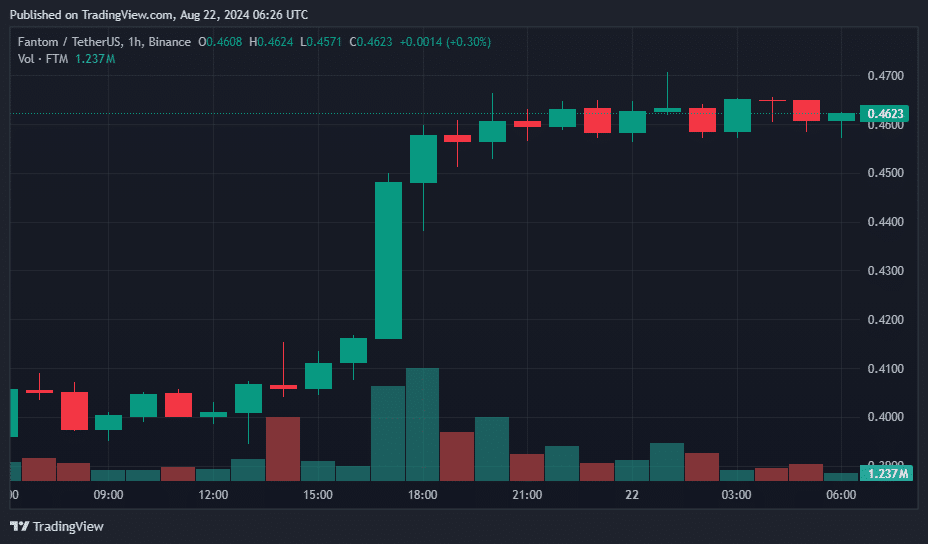

Fantom (FTM), a blockchain platform optimized for decentralized finance applications, soared 17% in value on the morning of Aug. 22, exchanging hands at $0.461 per price data from crypto.news. The crypto asset’s daily trading volume jumped more than double from the past day, hovering around $284 million, while its market cap stood at $1.29 billion, ranking it 62nd among the top largest cryptocurrencies.

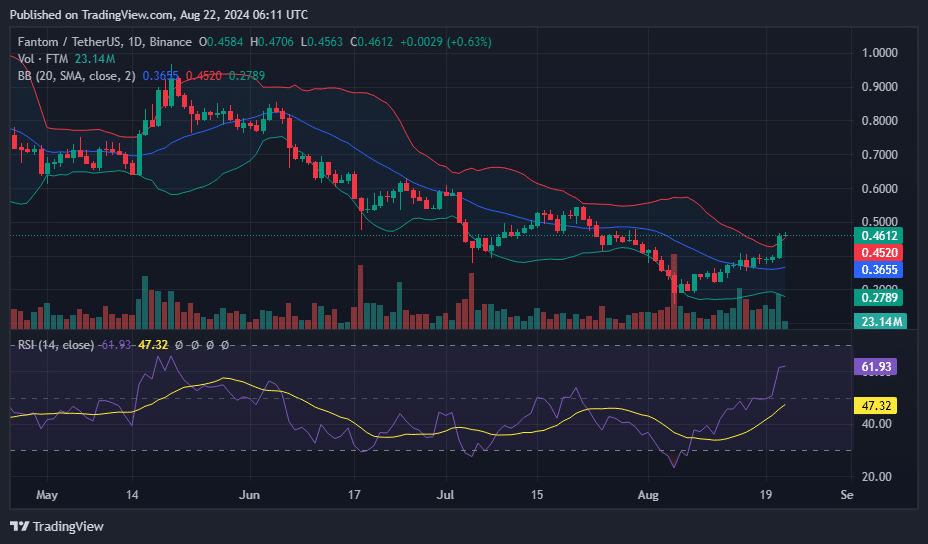

The token’s price has jumped by 67% since its drop to $0.276 on Aug. 5, when the crypto and stock markets crashed, leading to over $1 billion in liquidations. Despite the latest price surge, FTM is still down 86.6% from its all-time high of $3.46 recorded in October 2021.

Fantom‘s current price at $0.4621 positions it above the upper Bollinger Band at $0.4520, signaling a potential breakout from typical volatility levels. This position above both the middle band at $0.3655 and the upper band suggests an unusual upward momentum in the market, indicative of a strong bullish sentiment.

Given that FTM price exceeds the upper Bollinger Band, there could be concerns about the asset becoming overbought, but the Relative Strength Index at 61.93, while elevated, still does not firmly categorize the asset as overbought, which would typically be indicated by an RSI over 70. This suggests that while the buying momentum is strong, there may still be room for upward movement before the asset enters potentially overbought territory.

The scenario reflects a market that has possibly reacted to positive stimuli, propelling the price above usual resistance levels but not yet to a point of reversal based on overbuying. This can attract further interest from traders looking to capitalize on the momentum, potentially pushing the price even higher in the short term.

However, traders should also be cautious of any rapid changes that could lead to a quick retracement if the price adjusts back into the normal range of the Bollinger Bands.